Connect with us

Welcome to BestAdvise4U.com, your ultimate guide to achieving a healthy lifestyle! In today’s fast-paced world, it’s easy to neglect our health and well-being. But here’s the...

Welcome to the thrilling world of bestadvise4u.com, where exciting features and upgrades are about to take centre stage! We understand the importance of keeping our website...

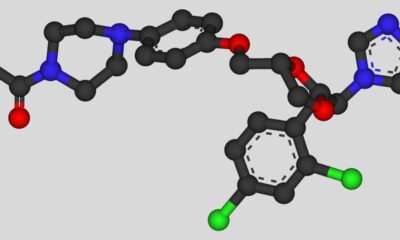

Welcome to the fascinating world of Quetaquenosol! In this blog post, we will unravel the wonders of this remarkable compound and explore its various uses, benefits,...