Welcome to our comprehensive review of Maximizecache.shop, the must-have tool for web developers! If you’re a tech enthusiast or someone who loves gadgets and fashion, then...

Welcome to the exciting world of Pikruo! In this blog post, we will delve into the origins and popularity of this fascinating phenomenon. Whether you’re a...

Health is wealth, they say, and in the digital age, maintaining well-being has become more accessible than ever. 10desires.org Health emerges as a beacon in the...

Artificial Intelligence (AI) has become a cornerstone in reshaping the landscape of healthcare. As we witness an unprecedented integration of technology and medicine, platforms like AIOtechnical.com...

Smartphones have become an integral part of our daily lives, and with each passing day, technological advancements continue to redefine our expectations. The geekzilla.tech Honor Magic...

In a world dominated by digital solutions, the demand for efficient and versatile productivity tools is ever-growing. Enter Jablw.rv, a platform that has been making waves...

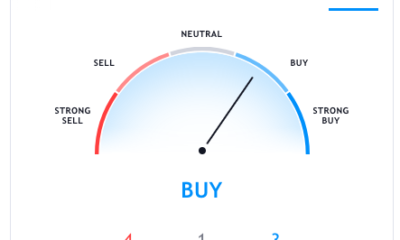

Cryptocurrencies have become a prominent feature of the global financial landscape, capturing the attention of investors and enthusiasts alike. Among the myriad of digital assets, dent...

Life finance is a multifaceted concept that encompasses the financial decisions and strategies individuals employ to secure their present and future well-being. Achieving financial stability requires...

Lights, camera, action! The world of online movie streaming has undergone a revolution like never before with the emergence of a new phenomenon known as “кинокрадко.”...

Have you ever received a call from an unfamiliar number, only to discover it was a scammer trying to trick you out of your hard-earned money?...